Contents

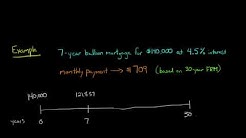

Brief Definition. A fixed-balloon mortgage allows the homeowner to pay only the monthly interest rate for a specified period, usually five, seven or 10 years, during the early stage of the amortization period. After the initial term expires, the remainder of the balance is due in one lump sum, or "balloon payment."

A balloon mortgage is a type of loan that requires a borrower to fulfill repayment in a lump sum. These types of mortgages may be payment free.

Learn about balloon mortgages. Find out about the benefits and risks of this form of mortgage home loan which typically has a 5 year or 7 year.

Balloon mortgage definition: A balloon mortgage is a mortgage on which the repayments are relatively small until the. | Meaning, pronunciation, translations and examples

do not have a standardized definition prescribed by IFRS and are, therefore, unlikely to be comparable to similar measures presented by other reporting issuers. The Fund uses these measures to.

Use this balloon mortgage calculator to view the change in principal over the life of the mortgage. This usually means you must refinance, sell your home or.

Use this balloon mortgage calculator to view the change in principal over the life of the mortgage. This usually means you must refinance, sell your home or.

Five Year Mortgage Today, financial institutions offer hybrid ARMs-like PenFed’s 5/5 ARM, which has a fixed-rate for five years and then the rate adjusts once every five years. This is a unique mortgage product as most ARMs adjust annually after the initial fixed terms.What Is Balloon Financing honda car finance, Special Auto Finance FAQs – Provides Honda car finance and special auto finance faq information.. Are leasing and balloon financing available for non-Honda vehicles? Not through HFS.What Is A Ballon Payment A balloon loan is a type of loan that does not fully amortize over its term. Since it is not fully amortized, a balloon payment is required at the end of the term to repay the remaining principal.

Balloon Mortgage: A balloon mortgage is a type of short-term mortgage. Balloon mortgages require borrowers to make regular payments for a specific interval, then pay off the remaining balance.

A balloon mortgage is not ideal for borrowers unless they are positive that they will have the money to pay the balloon payment at the time of maturity. Use balloon mortgage in a sentence " You may want to take on a balloon mortgage if you think that will be an easier way to pay it all off.

In other respects, a balloon mortgage resembles an adjustable rate mortgage (arm) with an initial rate period equal to the balloon period. A 7-year balloon, for example, is usually compared to a 7-year ARM. Both have a fixed-rate for 7 years, after which the rate will be adjusted.

Balloon Payment Loan Calculator – With this balloon payment calculator you can get the monthly and balloon payment or just the balloon payment itself. It’s also useful as a payoff calculator. free, fast and easy to use online!