Contents

You’ve saved a down payment, got your credit score up and you’re ready to start shopping for a house. The next step is to figure out how much house you can afford and how much money the bank will let.

You can see how much you could borrow based on your income with this mortgage calculator. The simple online tool shows you the amount you could borrow as a mortgage so you know before you apply.

How much can I borrow with an FHA loan? The U.S. Department of Housing and urban development (hud) sets the borrowing parameters on all FHA-guaranteed mortgages. One of biggest differences between FHA loans and other mortgages are the loan limits. loan limits are the maximum amount a person can borrow on a mortgage.

How much can I borrow with an FHA loan? The U.S. Department of Housing and urban development (hud) sets the borrowing parameters on all FHA-guaranteed mortgages. One of biggest differences between FHA loans and other mortgages are the loan limits. loan limits are the maximum amount a person can borrow on a mortgage.

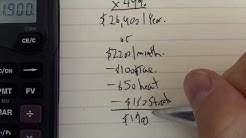

Before deciding how much you want to borrow, it’s good to have a budget and be clear on what you can actually afford to pay back each month. Our budget calculator is a great way to compare all your monthly income and outgoings, see what you have left afterwards, and get a good picture of your current financial position.

Who Pays Closing Costs On Fha Loan FHA loans have a minium down payment requirement as low as 3.5%. This amount excludes any closing costs, as closing cost payments may not be counted as part of the downpayment: Closing costs (non-recurring closing costs, pre-paid expenses, and discount points) may not be used to help meet the borrower’s minimum required investment.

You May Qualify for a Loan Amount Up to: fha requires a 3.5% down payment as well as an upfront and monthly mortgage insurance in many cases. Other loan programs are available. Calculations by this tool are believed to be accurate, yet are not guaranteed. See upfront and monthly calculations: FHA Mortgage Insurance Requirements.

The current law states that you can borrow as much as 97 percent of the home's value. However, this is true only if that number doesn't exceed the FHA.

Use our mortgage calculator to view our current mortgage deals. You’ll get an idea of how much you could borrow and compare monthly payments. This calculator is for illustrative purposes only and is not a mortgage offer. Before agreeing a loan, a credit search and full application is required, and our lending requirements must be met.

Fha Disaster Loan · FHA expands on foreclosure relief for 2017 disaster victims Kelsey Ramírez is an Associate Editor at HousingWire. In this role she spearheads the production of HW Magazine.

Find out how much you can afford to borrow with NerdWallet’s mortgage calculator. Just enter your income, debts and some other information to get NerdWallet’s recommendation for how big a mortgage.

When buying a home, the question “How much can I borrow?” should be the second question you ask. The most important consideration is, “How much house can I afford?” That’s because, even with all the.

Texas Fha Loan Requirements FHA Can Avoid Gov’t Bailout, Commissioner Testifies – The agency took on a great deal of stress during the downturn in its role as a counter-cyclical force in the mortgage market, Galante said, but despite criticisms has raised premiums and instituted.